A platform that enables smarter conversations.

The Bank of Montreal needed a better way to handle sales and onboarding. Bankers were using different tools and saying different things about the same products, and customers were often asked the same questions more than once. BMO wanted a clear, consistent way to guide conversations and organize customer needs.

I led the design for a new digital tool that improved how branch staff talked to customers and captured their goals.

Insight

Prior to the starting, BMO hired IDEO to reimagine the in branch experience and make their customers feel more valued. One of IDEO’s recommendations was to launch a digital questionnaire asking people a few questions about what brings them into the branch. This would help bankers spend more time talking about goals and less time collecting basic information. Plus, the answers could be shared with others in the bank. We used this idea as our starting point.

Solution

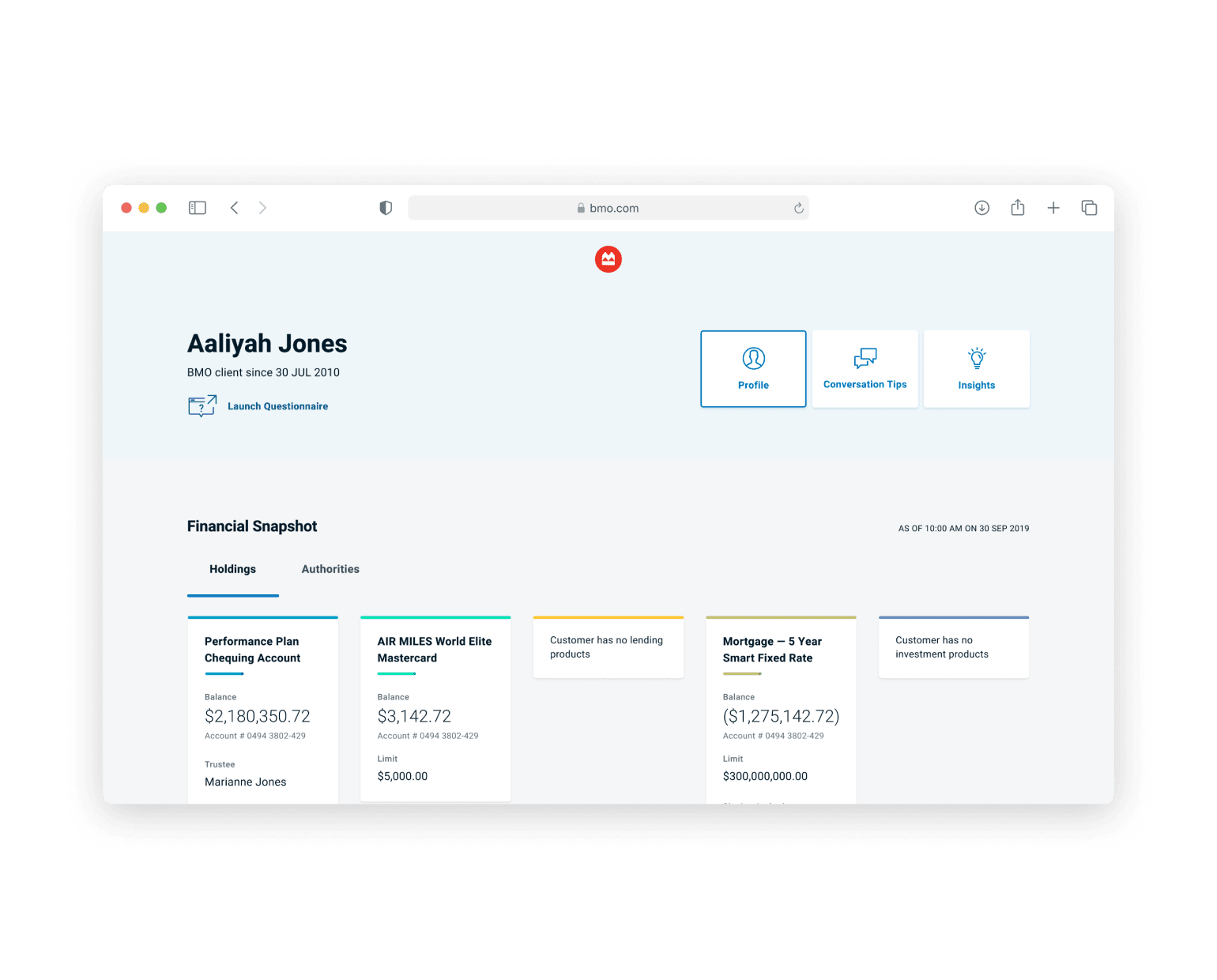

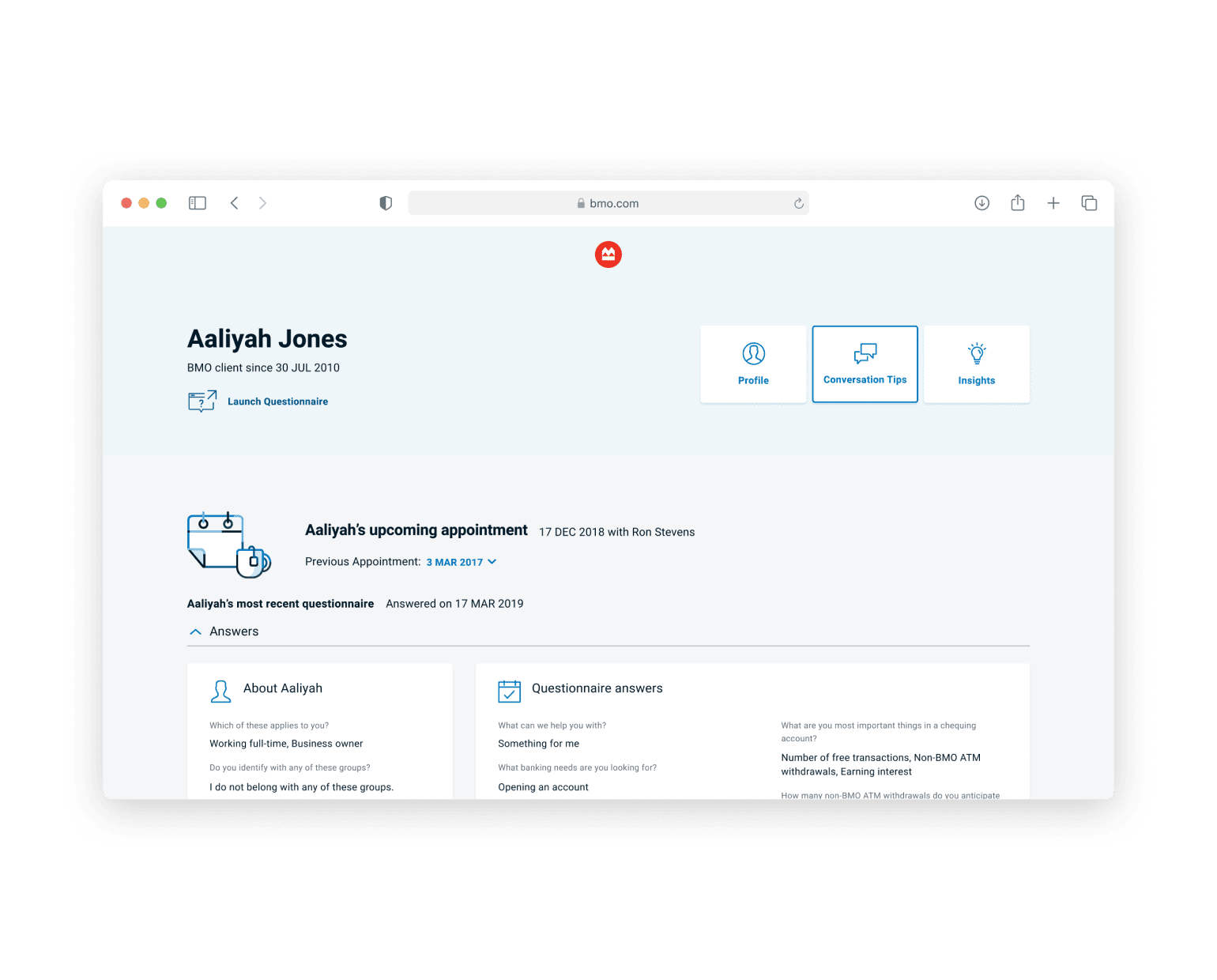

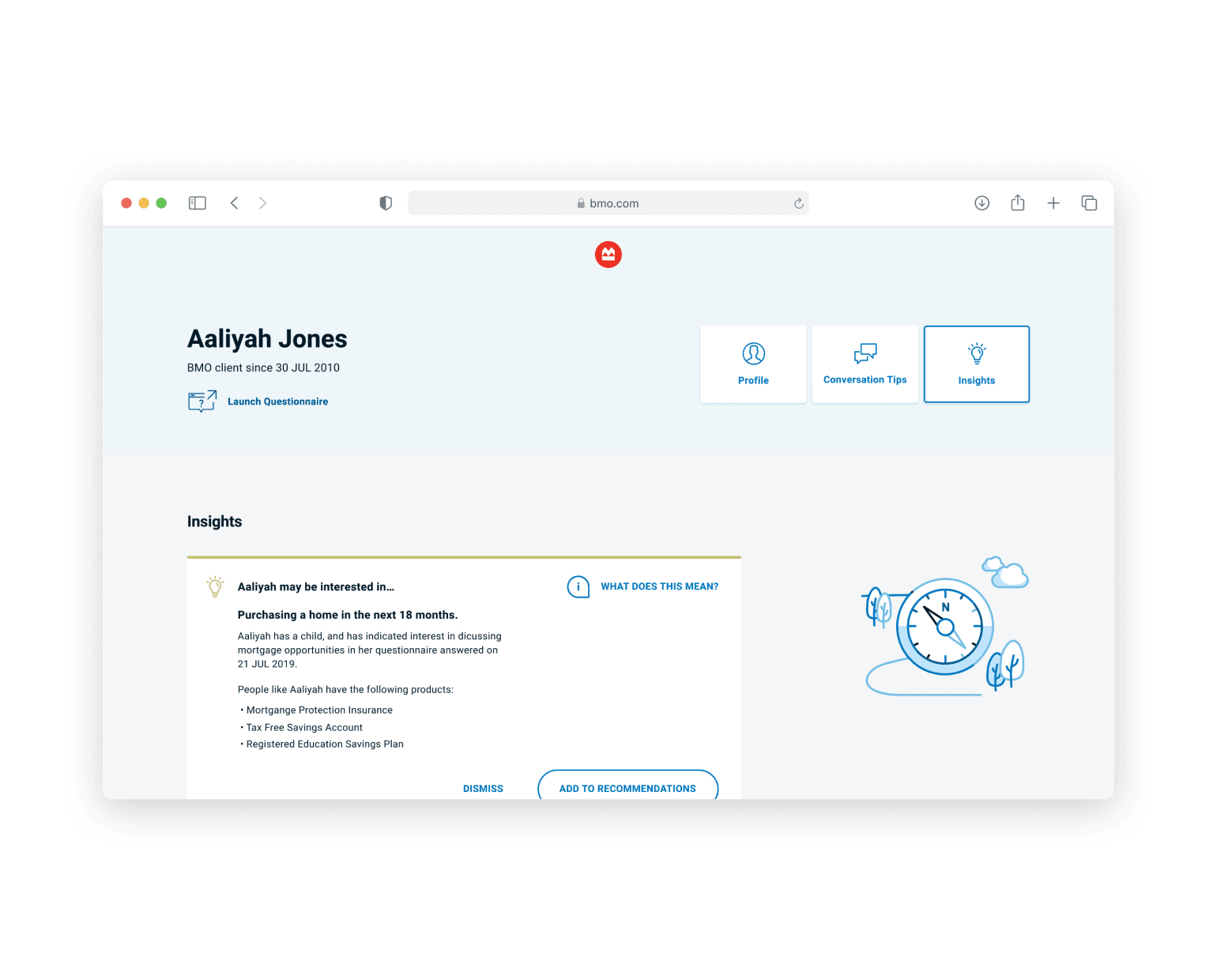

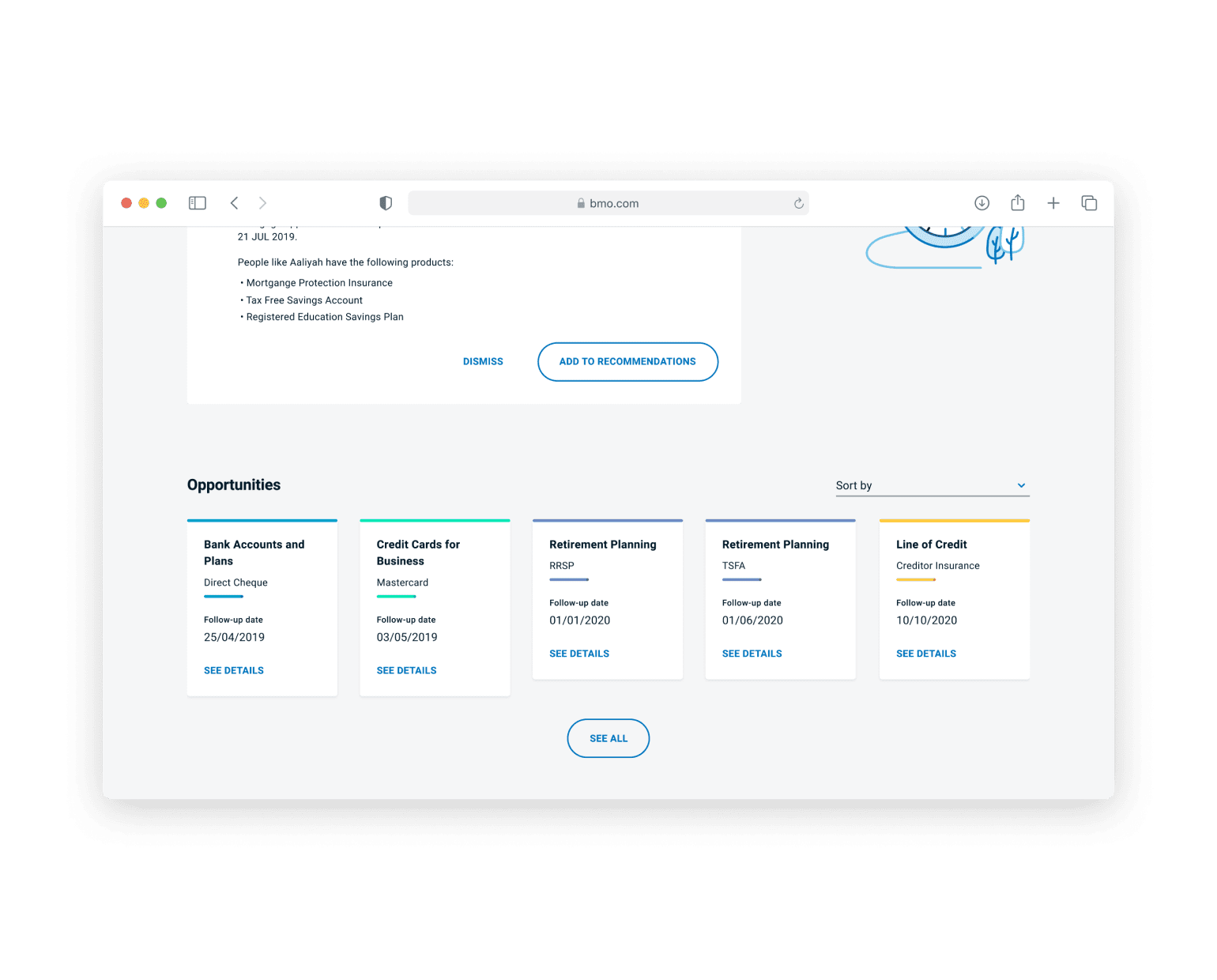

The Needs Navigator collects useful information from customers and gives personalized recommendations based on their situation and upcoming life events.

The experience starts with a simple questionnaire that customers can fill out on an iPad, either at home or in the branch. It asks easy, one-at-a-time questions. For new customers, it focuses on their financial goals and current situation. For returning ones, it checks if anything major has changed since their last visit.

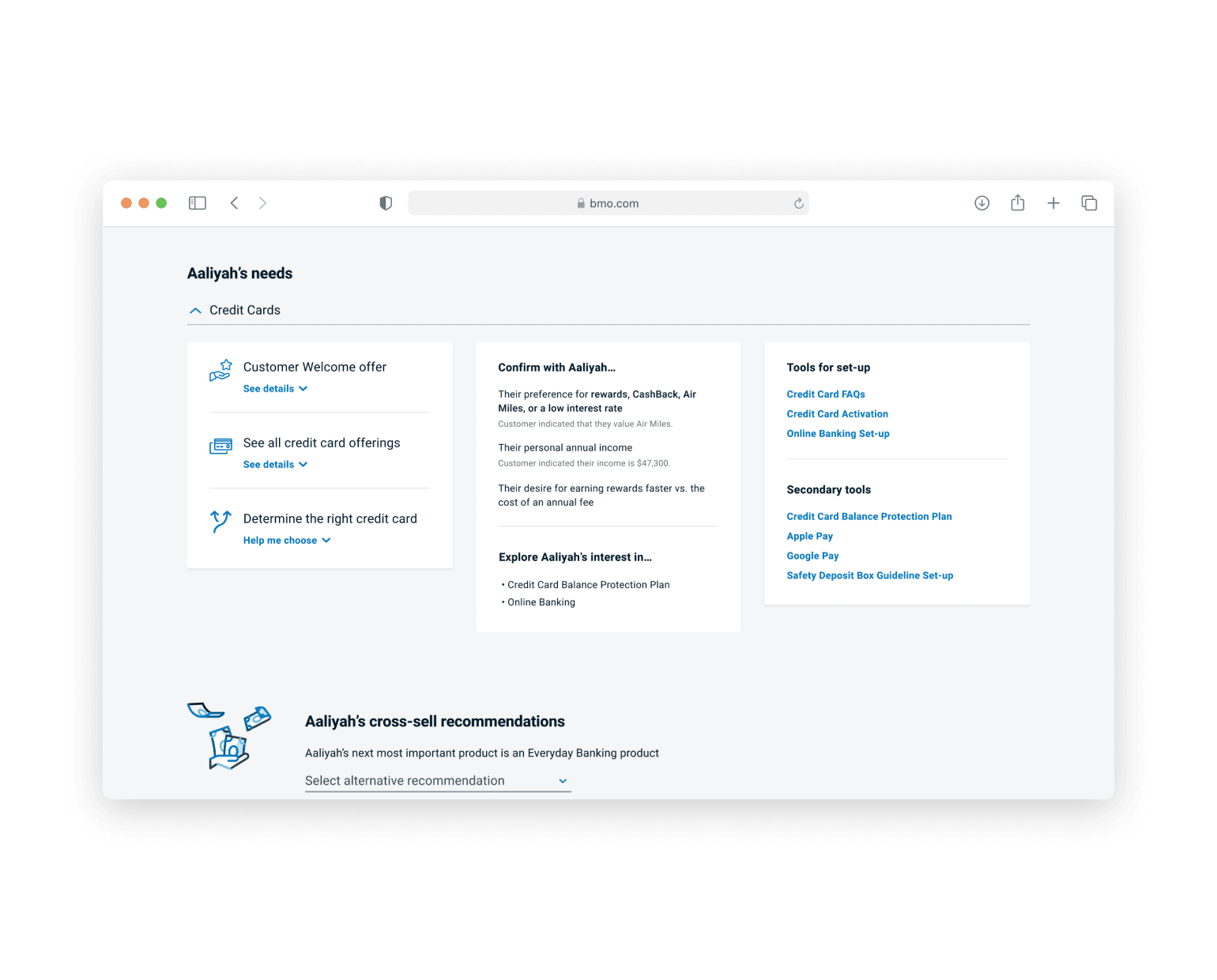

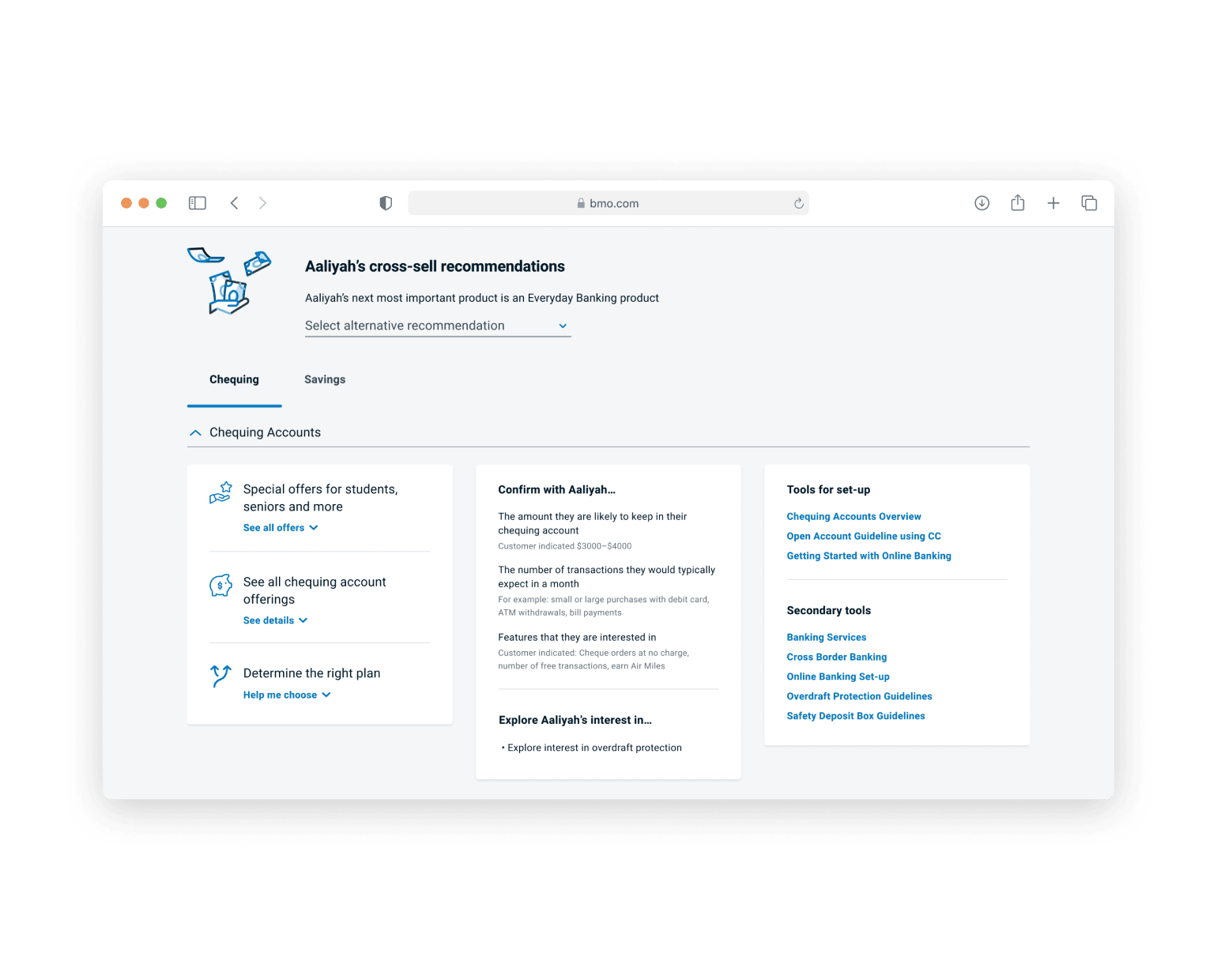

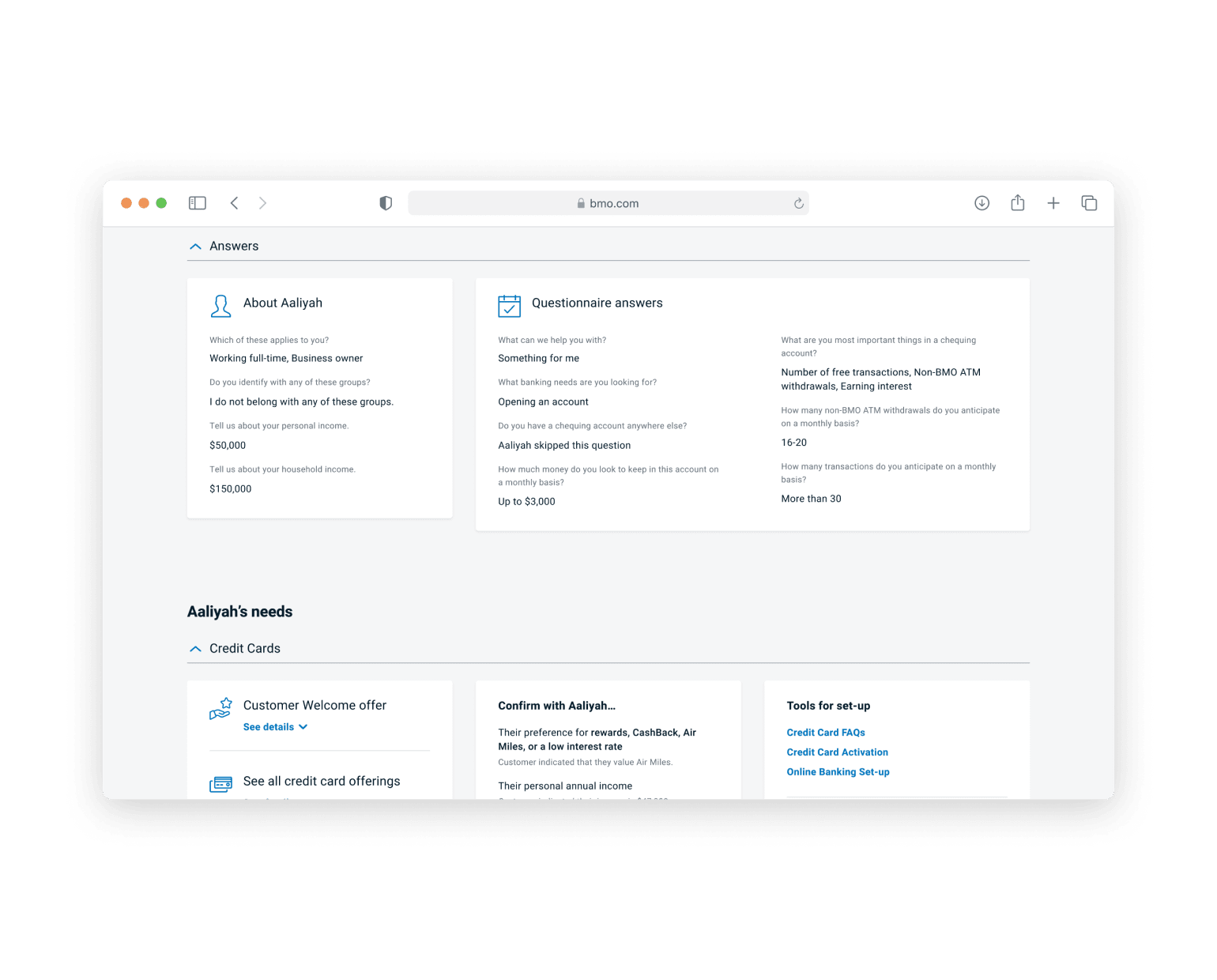

As customers answer the questions, bankers receive suggestions on what topics to discuss and quick reference guides to help explain the right products. These guides are available online and can be used during the conversation to keep things clear and helpful.

Challenges

Usability testing revealed that an early iteration of the interface was too complicated to manage during a face to face conversation with a client. It had a lot of the right functionality, but it needed to be simplified. The experience was meant to support the meeting, but in fact had become the focus. A subsequent iteration reduced the length of content down to 4 or 5 high level bullet points, which was effective at guiding the conversion without distracting people from it. Bankers preferred this version because it gave them space to add their own commentary and personality, while still hitting the right points.

Outcome

The Needs Navigator was launched across Canada. Bankers who used it were more productive—gaining about a day’s worth of extra time—and sold 30% more products to existing customers. Now, no matter where you go in Canada, you get a consistent banking experience that picks up right where you left off.