A platform that enables smarter conversations.

The Bank of Montreal's sales & onboarding process was in need of standardization. Products were described inconsistently and bankers were using bespoke tools and workflows to track prospective customers. When buying complex products, people were asked duplicative questions and heard contradictory messages about what products and services were right for them. BMO needed something to to consistently guide sales conversations, and help their branch staff capture people’s needs.

I was the design lead on the assignment, working with with a small cross functional team to build a new digital product that created a better, more consistent onboarding experience for the bank.

Insight

Prior to the assignment starting, BMO hired IDEO to reimagine the in branch experience and make their customers feel more valued. One of IDEO’s recommendations was to launch a digital questionnaire asking people a few questions about what brings them into the branch. Their thinking was if the banker could gather this information in advance, they could spend more time speaking to customers about their lives and goals and less time collecting their details. And, since it was digital, the person’s answers could be captured, cataloged, and made available for others across the bank. This was the starting point for the design team.

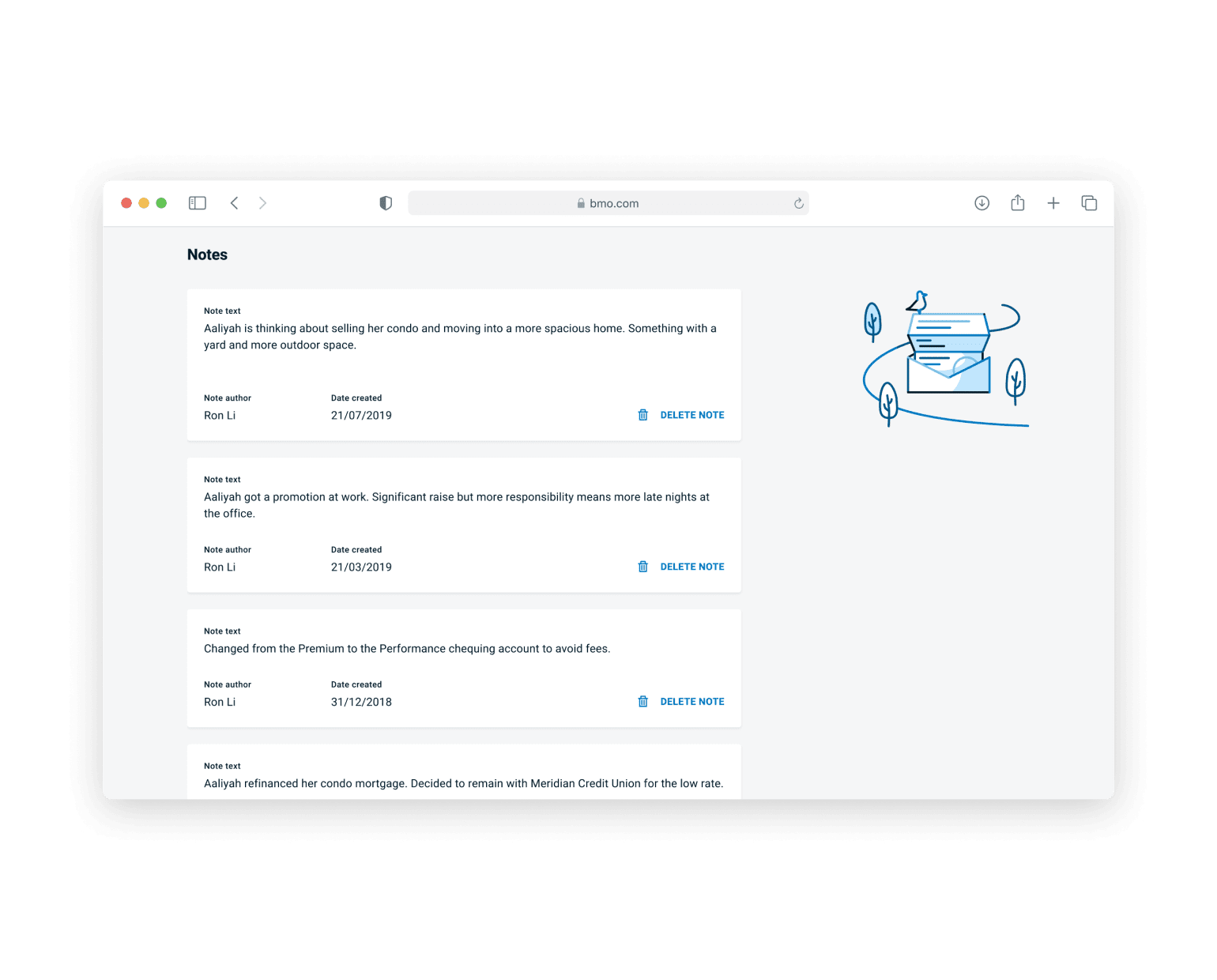

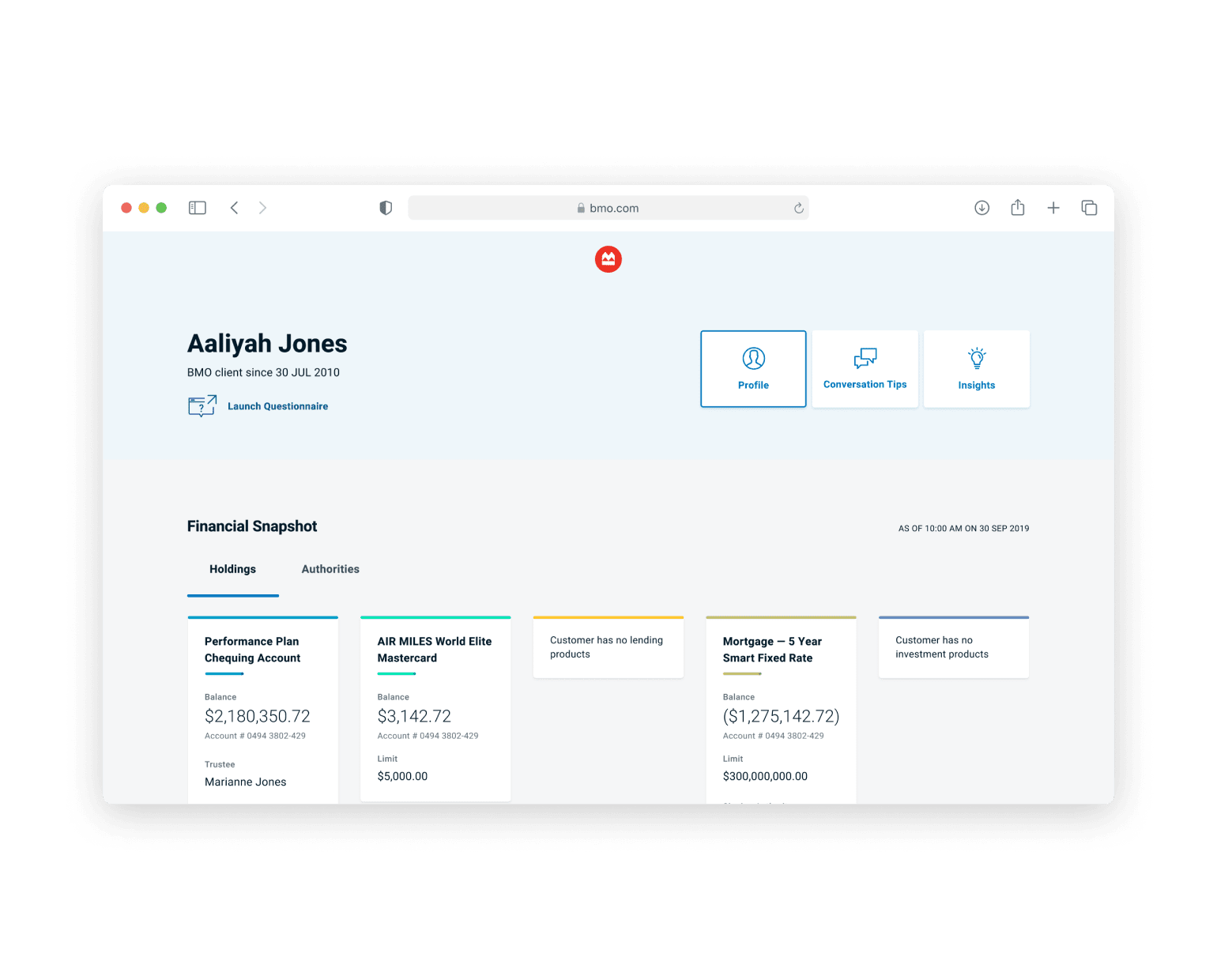

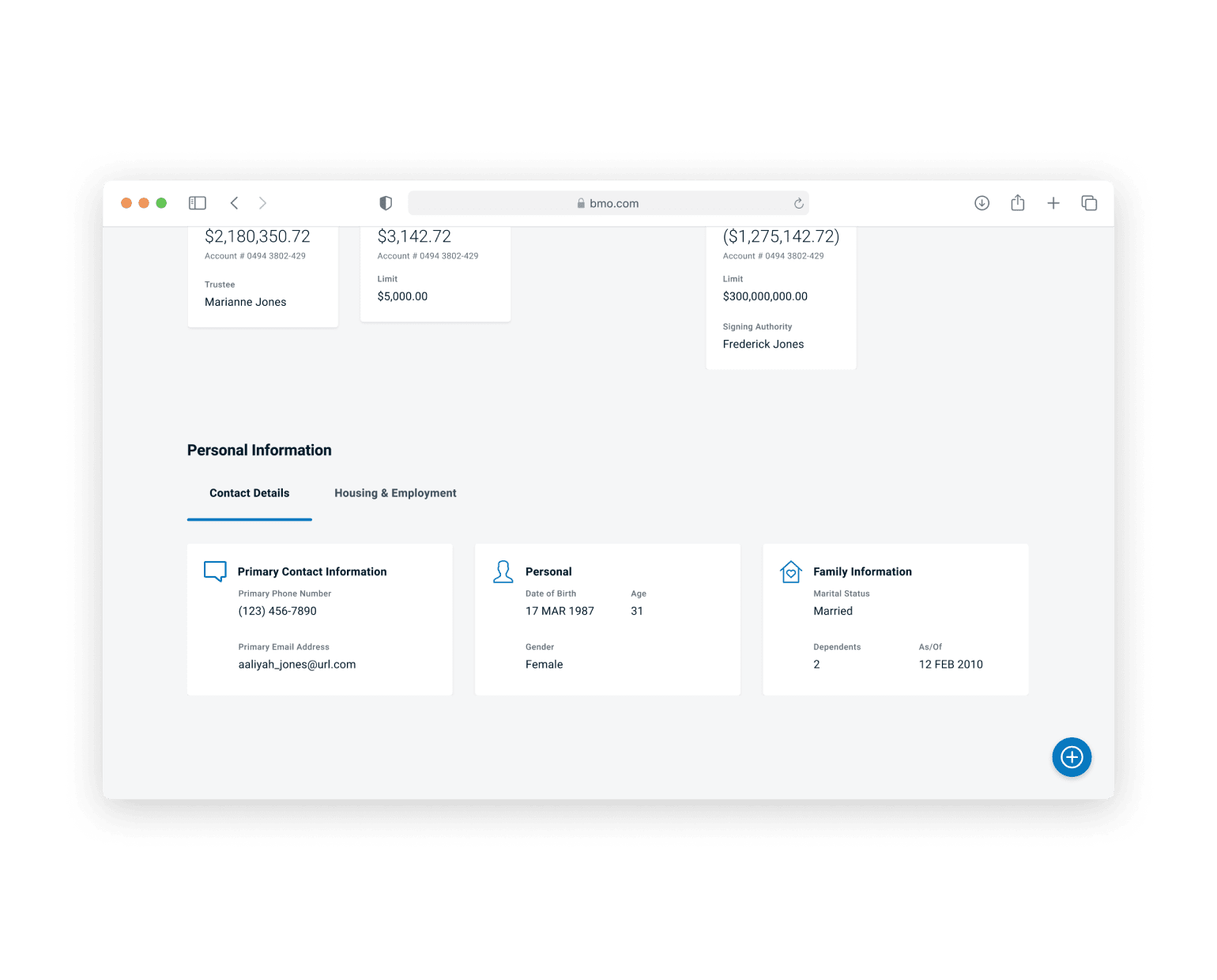

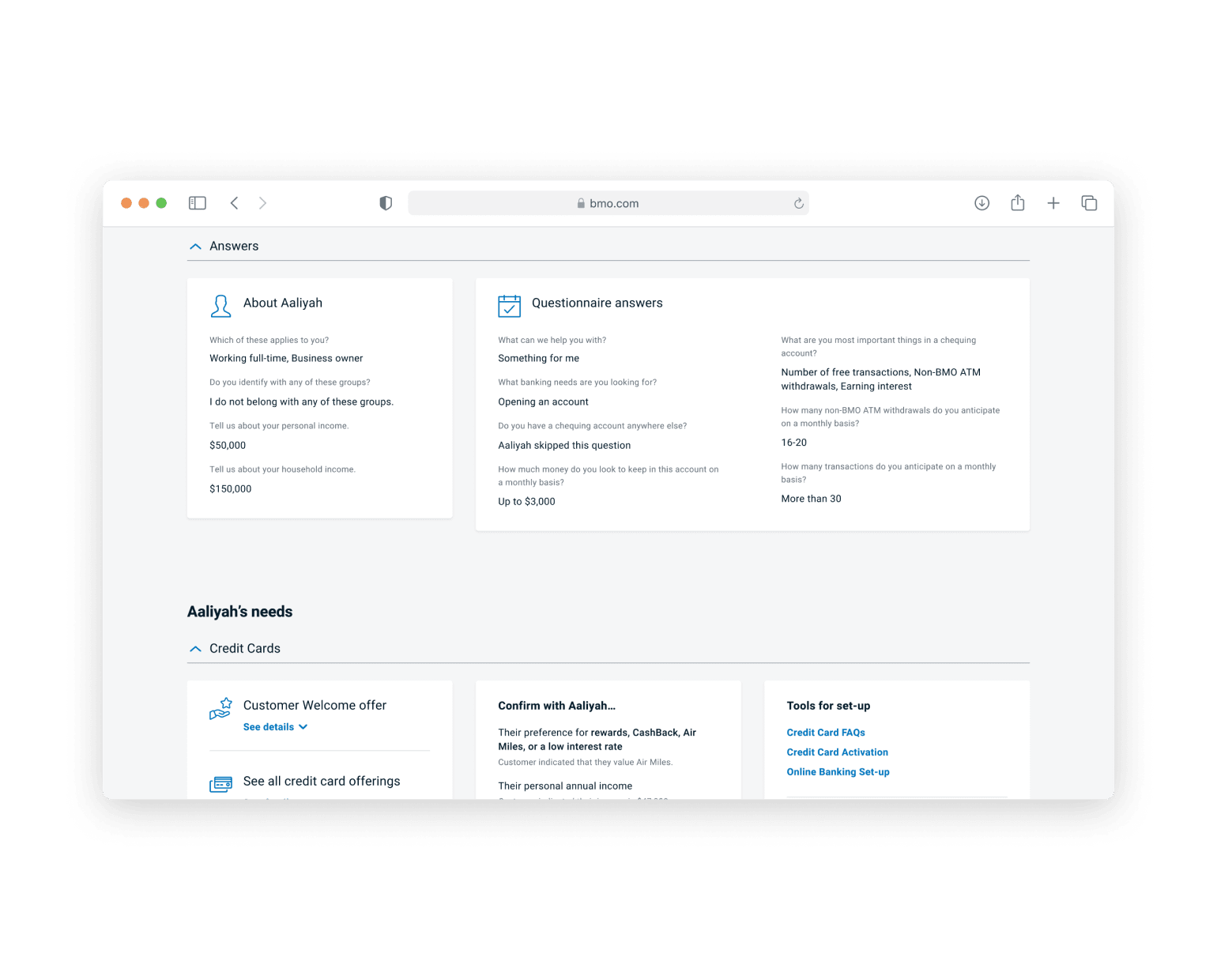

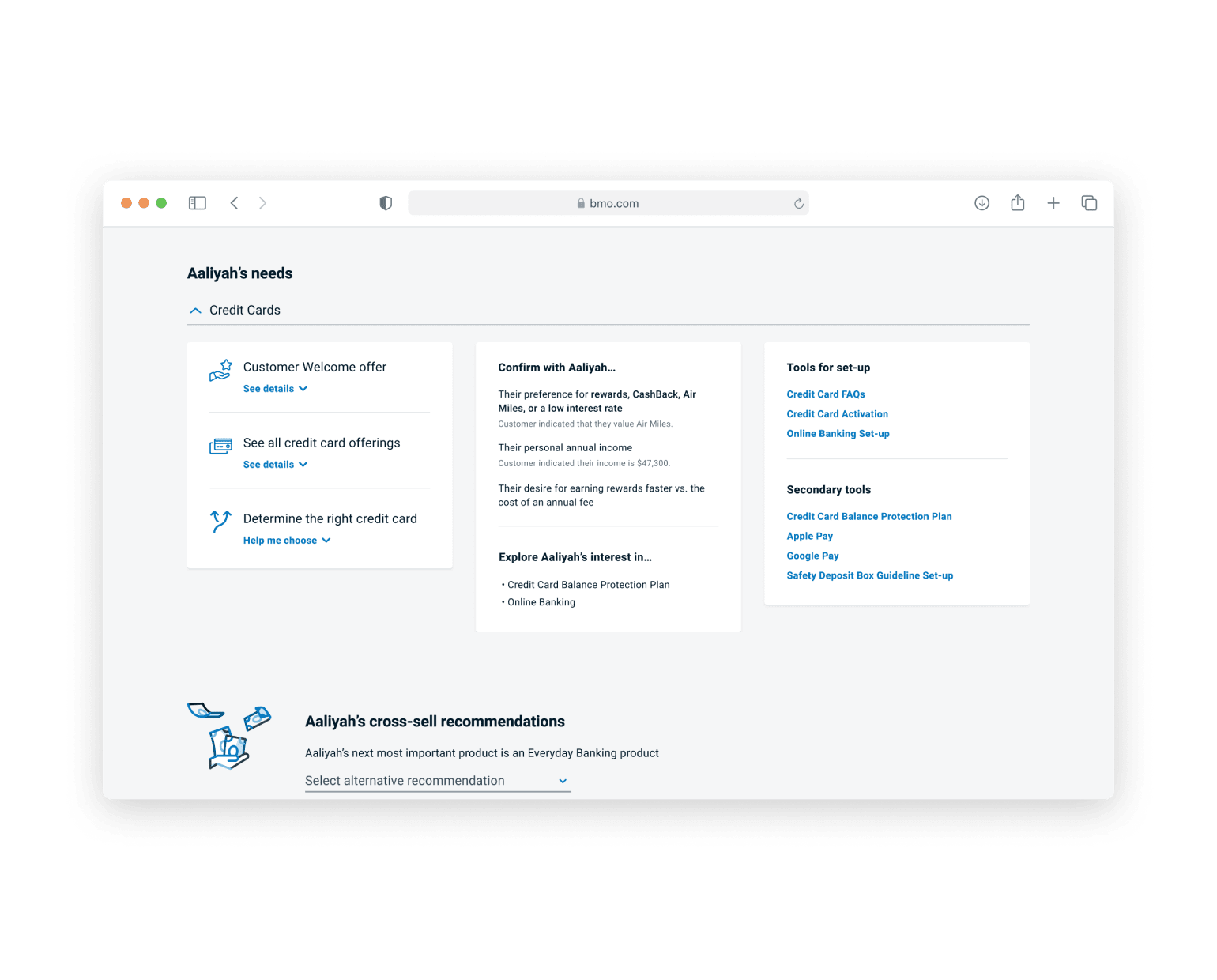

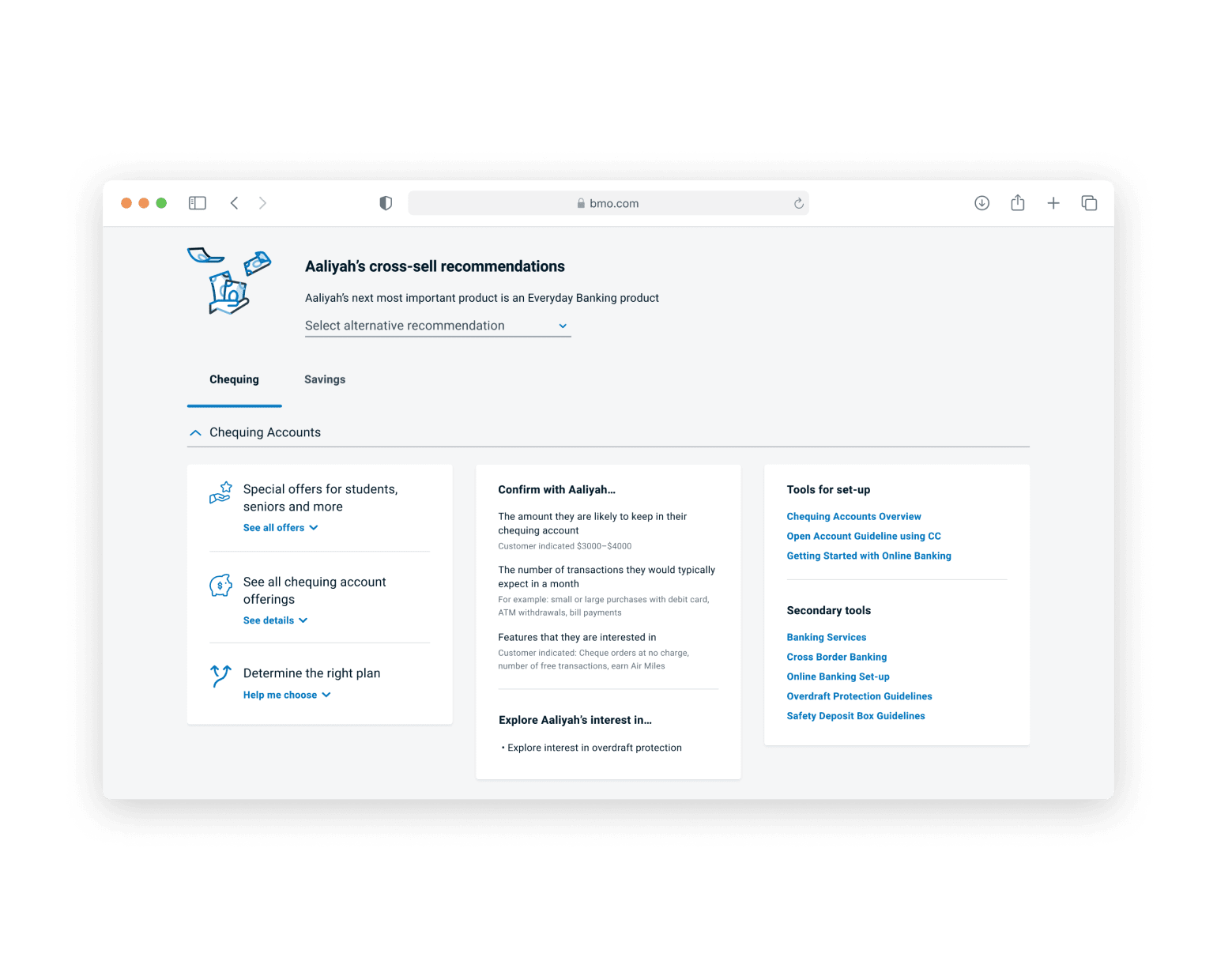

An at a glance view of the customer's products and balances

Relevant tools to help drive a more meaningful conversation

Design

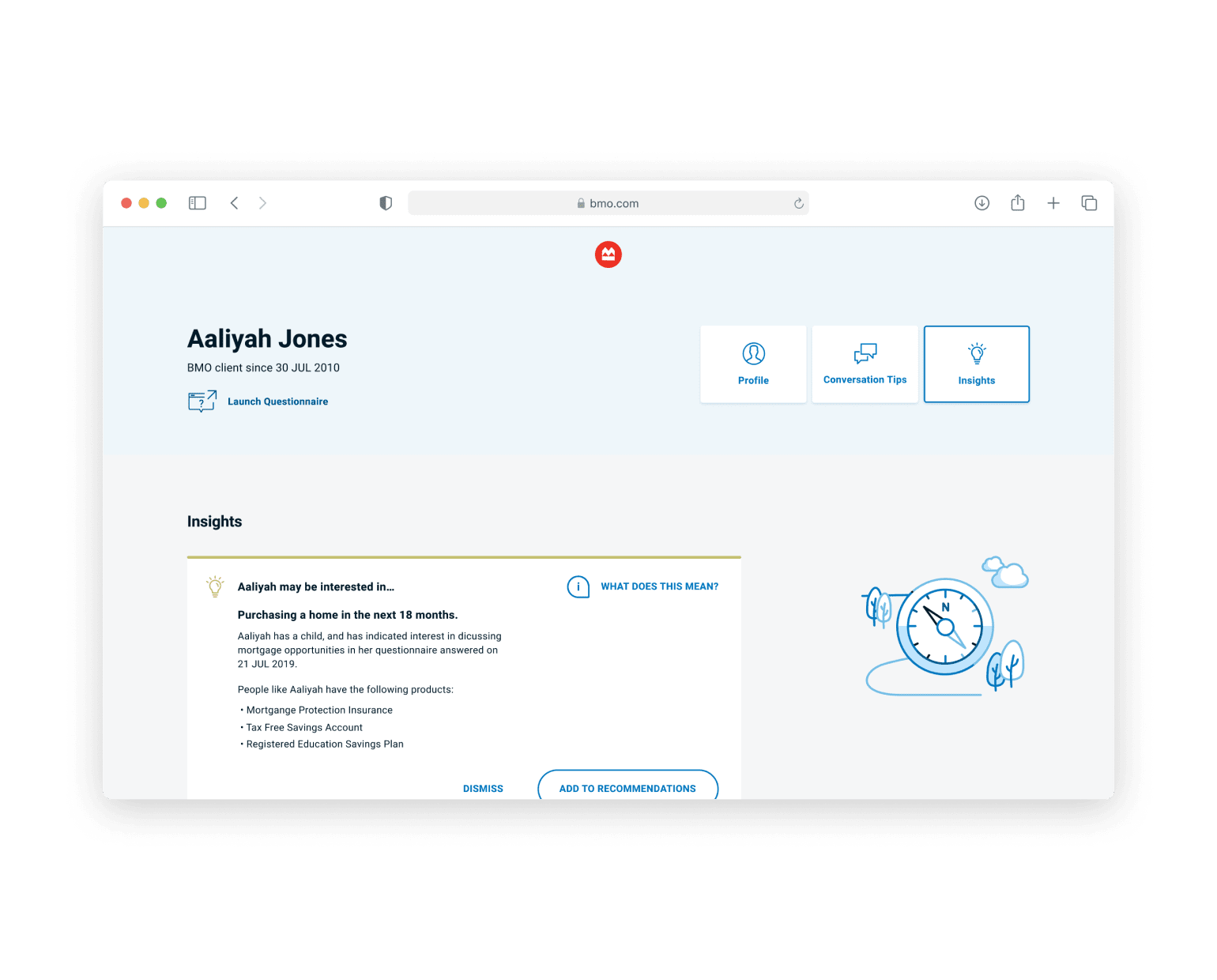

The Needs Navigator captures meaningful information from people, and serves up smart recommendations based on their unique circumstances and upcoming life milestones.

The platform was made up of two parts. On an iPad in branch or at home, customers would start with the questionnaire. It greeted them and asked simple questions, one at a time. For prospective customers, the questionnaire would focus on broad goals and understanding their current financial picture. For returning customers it would ask if there have been any big changes in their lives since their last visit.

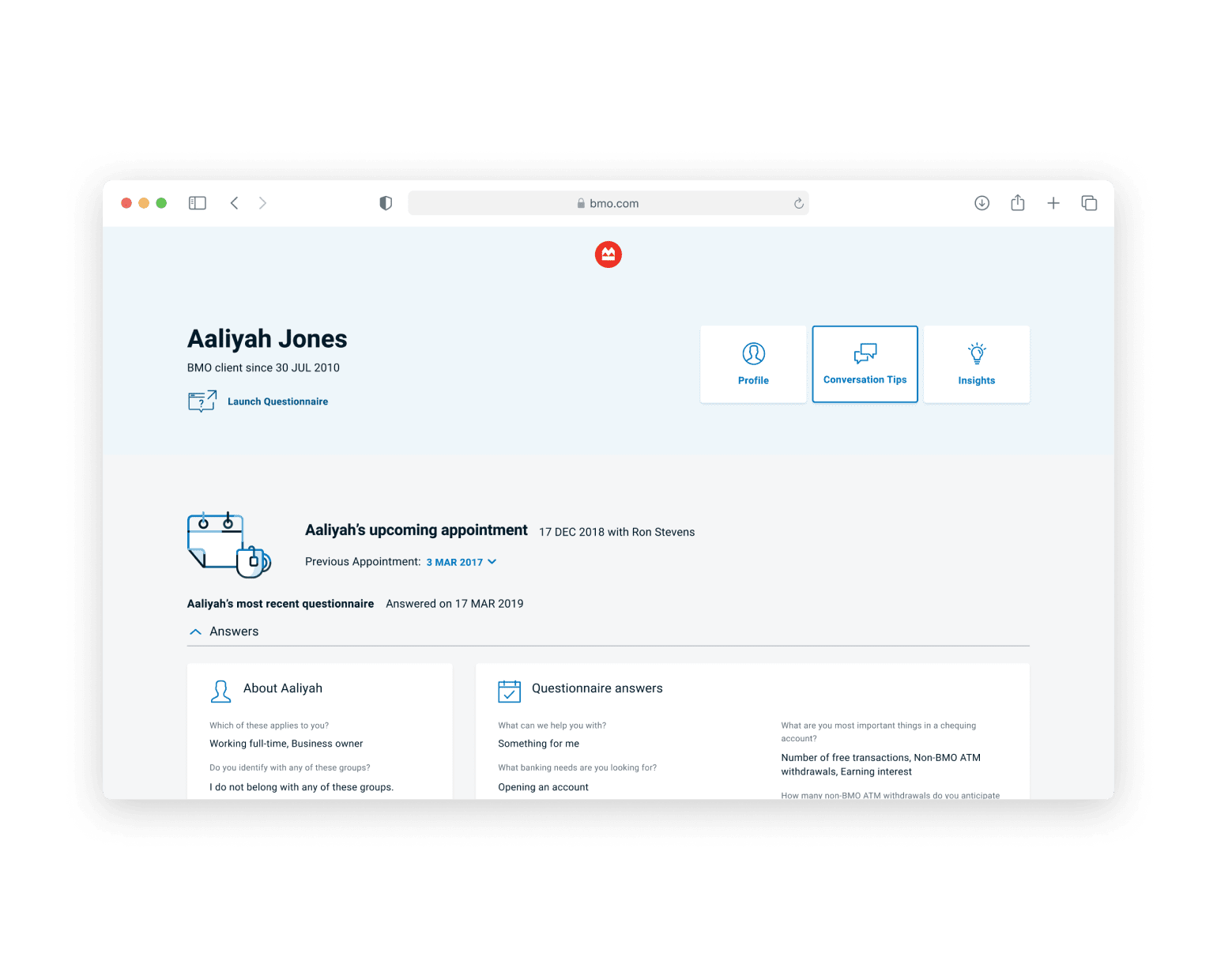

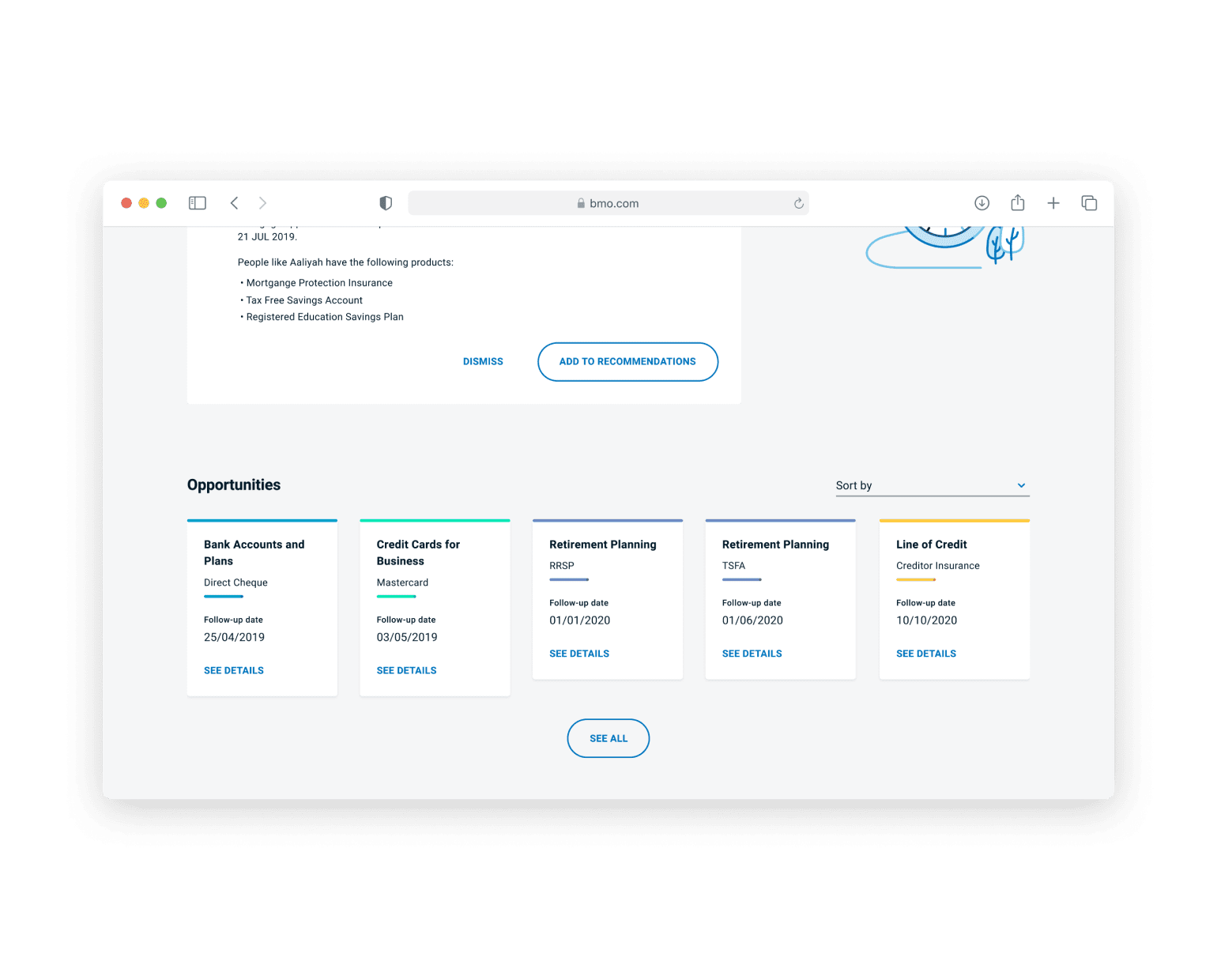

As prospective customers made their way through the questionnaire, bankers were given recommendations for conversations they should pursue, and at a glance guides for describing relevant products. Accessible through the web, the banker could pull up their conversation guides and reference them during the meeting.

Smart recommendations help bankers uncover opportunties

Challenges

Usability testing revealed that an early iteration of the interface was too complicated to manage during a face to face conversation with a client. It had a lot of the right functionality, but it needed to be simplified. The experience was meant to support the meeting, but in fact had become the focus. A subsequent iteration reduced the length of content down to 4 or 5 high level bullet points, which was effective at guiding the conversion without distracting people from it.

Outcome

Rolled out across Canada, the Needs Navigator has helped thousands of bankers have smarter more productive conversations with their customers. Those who adopted the tool gained the equivalent of an extra day of productivity, strengthening relationships and selling over 30% more products to existing customers. Now, no matter who you speak to at a branch, and no matter where you are in Canada, you'll have a consistent experience that picks up the conversation exactly where you left off.